Level-funded plans are essentially pre-packaged partially self-insured health plans, with stop-loss coverage for groups as small as 5 employees.

What are self-insured health plans? Large companies have long been able to self-insure their health care coverage. Under a self-insured plan, employers directly cover the costs of their employees’ medical expenses. There is a third-party administrator (TPA) that administers the plan and charges the company an administration fee.

Small groups, however, have not had the scale, systems, or process to self-insure. In short, it has been too onerous and risky for them to self-insure. Which lead to the creation of level-funded plans.

What is a Level-funded plan?

Level-funded plans are essentially pre-packaged partially self-funded health plans, with the financial predictability of a fully funded plan. Because of their structure, level-funded plans do not have the volatility in monthly cash flows, associated with self-insured plans, that can cripple a small business.

How does a level-funded plan work?

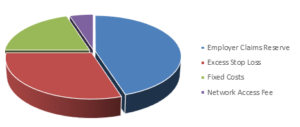

Like fully insured group plans, level-funded plans are underwritten. Consequently, they tend to be attractive to healthier groups. A census is provided to the TPA who determines a monthly cost comprised of four elements.

Part of each month’s premium will go into a claims fund which is the pool of money used to pay employee medical costs. The TPA fee goes towards paying for the administration of the program, including adjudicating claims. And the stop-loss premium goes towards that coverage. As claims come in on a monthly basis, the TPA pays them out of the claims allowance. If there is an extraordinary claim on an individual or aggregate basis, the stop-loss kicks in. In no case does the employer have to pay more than the level amount.

Annually, the performance of the group is evaluated. If the group has performed well, some of that claim allowance may be returned to the group.

What if the group has a really bad year? In a bad year, the stop-loss kicks in to protect the employer. Again, the entire concept of the level-funded plan is that the employer never has to pay more than the level monthly amount. But as an underwritten plan, it is reasonable to expect an increase — perhaps even an untenable increase. But unlike large groups a small group can simply revert back to a fully insured plan, which is not underwritten and is likely to be to their financial benefit.

Working with a good consultant who understands both the nuances of the level-funded plan and traditional health plan markets can be the difference between success and savings and frustration and increasing costs.

So, for small groups, the question is why not explore a level-funded plan? With the potential of a partial refund of the premium, protection against extraordinary costs, and the ability to fall back on an fully insured plan, there is very little reason not to do so.